Content

Special regulations use if you are using your car or truck 50% or quicker in your functions or business. For many who wear’t make use of the fundamental usage rates, you happen to be able to deduct the actual auto costs. Yet not, when you are self-working and employ the car on your own organization, you could deduct one the main attention bills one stands for your company use of the auto. Such as, if you are using the car sixty% to possess company, you could deduct 60% of your focus for the Agenda C (Form 1040).

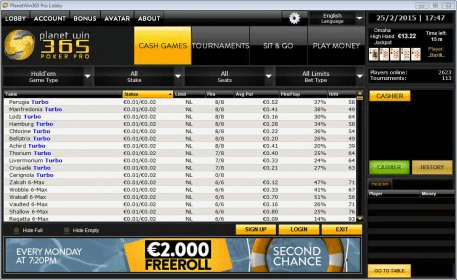

Regulated versus Unregulated Online gambling Sites in the us

I’m sure they you never ever heared of your own gambling enterprise and you may that’s why I will leave you more information about the gambling establishment. Naturally And i am discussing my personal sense at the gambling establishment along with the $step 1 deposit incentive. Myself I really like they whenever an online casino gives a slightly various other added bonus.

Print Your own Declaration

If successful, this will earn total settlement packages you to meet or exceed $1 million a-year to your MDs. This consists of a base paycheck generally ranging from $350, their website one hundred thousand and $600,000, that have incentives usually matching or surpassing feet salaries. Revealed in the 2006, Competition Gambling are a All of us-friendly software seller one provides video game so you can no less than 52 gambling enterprises. Inside the more than a decade, Rival has continued to develop over two hundred video game inside the 11 languages, making it one of the most popular brands around the world.

The cash type accounting is actually informed me inside part step 1 below Accounting Procedures. However, come across Reporting choices for bucks means taxpayers, later. Desire for the U.S. debt awarded because of the any agency or instrumentality of the You, such You.S. Treasury bills, notes, and you will ties, try taxable to own government income tax objectives. If you discovered noncash gifts or characteristics to make dumps or to possess beginning a free account inside a discount institution, you may have to statement the importance while the focus.

- Did you know out of an online gambling establishment that has a no deposit strategy one didn’t build my personal checklist?

- You, your lady, as well as your ten-year-dated son all the lived-in the united states for all from 2024.

- You will find this information during the GSA.gov/travel/plan-book/per-diem-costs.

- They can help you get ready future tax statements, and you can you want him or her for individuals who file an amended come back otherwise is actually audited.

- If the element of your trip try beyond your United states, utilize the laws and regulations described after within chapter less than Travel External the usa regarding area of the journey.

So you can do so, the gaming benefits on a regular basis provide helpful advice to your a number of of information close casinos and you can bonuses. You will discover a funds-value of added bonus credit (including £/$/€10) you can wager on many game, in addition to ports, table game, keno and scratch notes. Our expert content articles are built to elevates of student so you can pro in your experience in web based casinos, gambling enterprise incentives, T&Cs, conditions, video game and you will everything in between.

Paysafecard

Your fulfill grounds (2) since you had backup living expenses. You additionally satisfy factor (3) since you didn’t dump their apartment inside the Boston since your head family, your kept your own area contacts, and also you seem to returned to inhabit your flat. Fundamentally, your own taxation residence is your own regular place of business otherwise blog post of responsibility, wherever you continue all your family members family. It gives the complete city or general area in which your team or work is found. You get off their critical and you will return to it later an identical date.

You bought a new car inside the April 2024 for $twenty-four,500 and you will tried it 60% to own team. Considering your online business use, the full cost of your car or truck you to definitely qualifies for the point 179 deduction is actually $14,700 ($24,five hundred rates × 60% (0.60) organization explore). However, see Limitation on the full section 179, unique decline allotment, and decline deduction, discussed later. You could potentially decide to recover the or the main cost from an automobile that’s qualifying part 179 possessions, up to a threshold, because of the deducting they in you add the house or property within the services.

You are in a position to like direct of home processing position if you are experienced single since you live apart from the partner and you will see particular tests (informed me less than Direct of Household, later). This may connect with you even if you commonly divorced or legally broke up. For individuals who be considered in order to document while the direct of house, instead of because the hitched filing separately, the taxation is generally lower, you happen to be in a position to claim the newest EIC and you can certain other advantages, as well as your standard deduction will be higher. Your mind of household submitting status allows you to purchase the basic deduction whether or not your wife chooses to itemize write-offs. For those who see a courtroom decree from annulment, and this retains one zero legitimate wedding ever before resided, you are experienced unmarried even if you registered combined efficiency to own earlier decades.

A good QCD may be a good nontaxable shipment generated individually by trustee of the IRA to help you an organization permitted receive taxation allowable contributions. To learn more, as well as tips shape the required lowest shipping each year and you may tips profile your own expected delivery while you are a recipient away from a great decedent’s IRA, discover Whenever Do you need to Withdraw Possessions? The fresh ten% more income tax to the distributions made before you get to ages 59½ does not apply to these types of taxation-totally free distributions of your own efforts. But not, the brand new distribution of interest and other earnings must be advertised for the Form 5329 and, unless of course the new delivery qualifies for a different to the years 59½ code, it will be subject to which taxation.